Nvidia's financial outlook has taken a significant hit as new US export restrictions disrupt its ability to tap into China's booming AI market, TechCrunch reported. The semiconductor giant, in its first-quarter earnings for fiscal year 2026, ending April 28, disclosed a $4.5 billion charge stemming from licensing requirements that hinder sales of its H20 AI chip to Chinese firms. Additionally, the company was unable to ship products worth $2.5 billion in anticipated revenue due to these constraints, marking a substantial setback for its global ambitions.

NVIDIA disclosed a robust financial performance for the first quarter of fiscal 2026, ending April 27, 2025, with revenue reaching $44.1 billion, a 12% increase from the prior quarter and a 69% leap from the same period last year. The company faced a significant hurdle with a $4.5 billion charge due to new US export licensing requirements for its H20 products targeting the China market, which curtailed $2.5 billion in potential revenue. Despite this, NVIDIA's Data Center segment thrived, generating $39.1 billion, up 10% sequentially and 73% year-over-year.

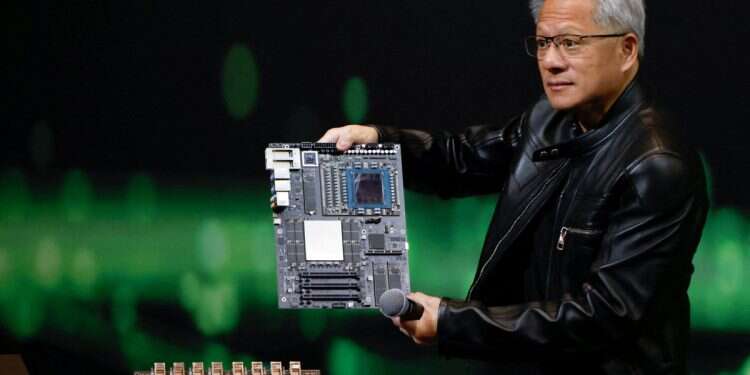

The H20 export restrictions, announced by the US government on April 9, 2025, led to a $4.5 billion charge for excess inventory and purchase obligations, as demand for these products waned, NVIDIA News noted. Before the restrictions, H20 sales reached $4.6 billion. The company's GAAP gross margin stood at 60.5%, while the non-GAAP margin was 61.0%; excluding the H20 charge, the non-GAAP margin would have been 71.3%. "Our breakthrough Blackwell NVL7279 AI supercomputer – a 'thinking machine' designed for reasoning — is now in full-scale production across system makers and cloud service providers," Jensen Huang, NVIDIA's founder and CEO, said.

The initial announcement of the US licensing rules in April led Nvidia to anticipate a $5.5 billion charge for the first quarter, according to TechCrunch. This figure reflects the company's early estimates of the financial toll imposed by the restrictions. The inability to sell its H20 chip, designed specifically for AI applications, has disrupted Nvidia's operations in one of the world's most critical technology markets, forcing the company to recalibrate its strategy.

Looking ahead, Nvidia projects an even steeper impact in its second quarter, with an expected revenue loss of $8 billion, as reported by TechCrunch. This forecast comes as the company predicts total Q2 revenue of approximately $45 billion, underscoring the magnitude of the export restrictions' effect. The limitations have effectively barred Nvidia from accessing China's $50 billion AI market, a region that CEO Jensen Huang described as pivotal for global leadership in artificial intelligence.

During Nvidia's Q1 earnings call, Jensen Huang emphasized the strategic importance of China, noting, "China is one of the world's largest AI markets and a springboard to global success with half of the world's AI researchers based there; the platform that wins China is positioned to lead globally today," TechCrunch stated. Huang further lamented that the H20 export ban has "ended our Hopper data center business in China," adding, "We cannot reduce Hopper further to comply." These restrictions have forced Nvidia to write off its H20 chip inventory, as the company explores alternative ways to maintain a foothold in China's AI sector.

Nvidia has been vocal in its opposition to the Trump administration's efforts to curb exports of US-made AI chips to nations like China, according to TechCrunch. Huang praised the recent decision to abandon the Biden administration's proposed Artificial Intelligence Diffusion Rule, which would have tightened chip export controls further. This move, he argued, prevented additional barriers to Nvidia's operations in key markets.

Despite the reprieve from Biden-era rules, the Trump administration's policies continue to challenge Nvidia's growth, TechCrunch noted. Huang underscored the broader implications, stating, "The question is not whether China will have AI; it already does." He added, "The question is whether one of the world's largest AI markets will run on American platforms. Shielding Chinese chip makers from U.S. competition only strengthens them abroad and weakens America's position." These remarks highlight Nvidia's concerns about losing its competitive edge in a critical global market.