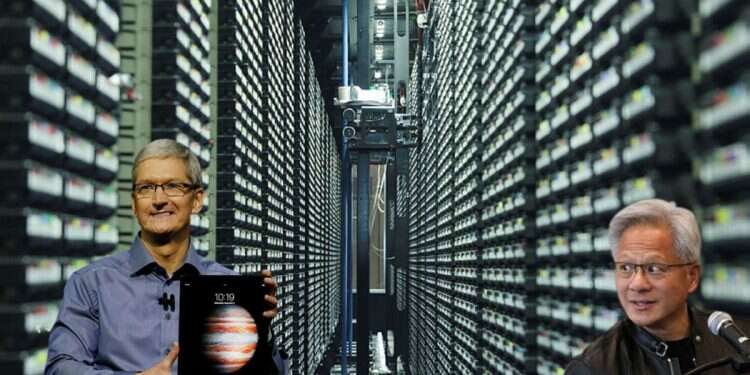

NVIDIA has reclaimed its position as the world's most valuable company, surpassing Apple with a market capitalization of $3.53 trillion, Yahoo Finance reported. The chipmaker's stock surged 3.1% on Monday, pushing its valuation ahead of Apple's $3.52 trillion. This milestone underscores NVIDIA's dominance in the artificial intelligence sector, where its chips power a wide range of AI applications.

The company's rapid ascent, adding roughly $1.4 trillion in market value this year alone, reflects Wall Street's enthusiasm for AI technologies, according to Yahoo Finance. NVIDIA's chips are critical for generative AI and its success is to a large extent a result of its Israeli operations and historic acquisition of Mellanox. The chips, which are used as graphics processing units and essentially allow breath-neck speed of AI responses, has fueled investor optimism and driven a 181% stock rally in 2025. "If you're going to bet on AI, NVIDIA is the safest bet," said Peter Boockvar, chief investment officer at Bleakley Financial Group, as quoted by Yahoo Finance.

NVIDIA's valuation now exceeds that of Apple and Microsoft, with the latter holding a market cap of $3.1 trillion. All three companies have crossed the $3 trillion threshold multiple times this year, highlighting the intense competition among tech giants. The chipmaker's focus on AI has positioned it as a leader in the industry, with its stock performance outpacing broader market indices.

The company's journey to this milestone began with its critical role in AI chip production. Under Chief Executive Officer Jensen Huang, NVIDIA has capitalized on the growing demand for AI infrastructure. "NVIDIA is firing on all cylinders," Ryan Detrick, chief market strategist at Carson Group, as cited by Yahoo Finance, said, emphasizing the company's ability to sustain its lead in the tech sector.

Despite its high valuation, some analysts warn of potential risks. Yahoo Finance reported that NVIDIA's stock trades at a forward price-to-earnings ratio of 31, compared to Apple's 25 and Microsoft's 27. This premium valuation could face scrutiny if market conditions shift, though investor confidence in NVIDIA's AI dominance remains strong for now.