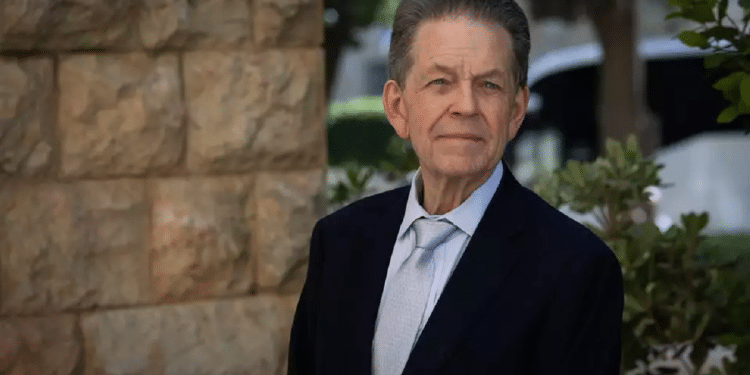

Professor Arthur Laffer, affectionately known as "Art" to his colleagues, has been guiding American presidents on economic management since 1970. When he was just 30, he directed the Office of Management and Budget under Richard Nixon. During the 1980s, he played a crucial role in developing Ronald Reagan's remarkably successful economic policies. Ever since, leaders regularly seek his counsel, including Israeli Prime Minister Benjamin Netanyahu. "He's wonderful," Laffer remarked about Netanyahu during our Thursday meeting in Jerusalem.

At 85, the distinguished economist's legacy lives on through the "Laffer Curve" in economic theory, which he originally drew on a restaurant napkin during a 1970s White House conversation. This curve demonstrates a fundamental economic concept – that reducing taxes can sometimes boost government revenues by encouraging greater tax compliance.

Laffer visited Israel following an invitation from the Israeli Center for Liberty, an organization championing conservative principles. He addressed audiences alongside artificial intelligence specialist Dr. Eli David, one of this year's Independence Day torchbearers. His itinerary included meetings with Netanyahu, Minister of Finance Bezalel Smotrich, their economic teams, and former Israeli students.

Despite his advanced age, Laffer maintains his energy and charm, continuing his role as an engaging educator. The primary subject I requested him to address concerns Donald Trump's global tariff revolution. To recap, the American president established substantial trade barriers designed to severely complicate most nations' ability to sell products in the US market.

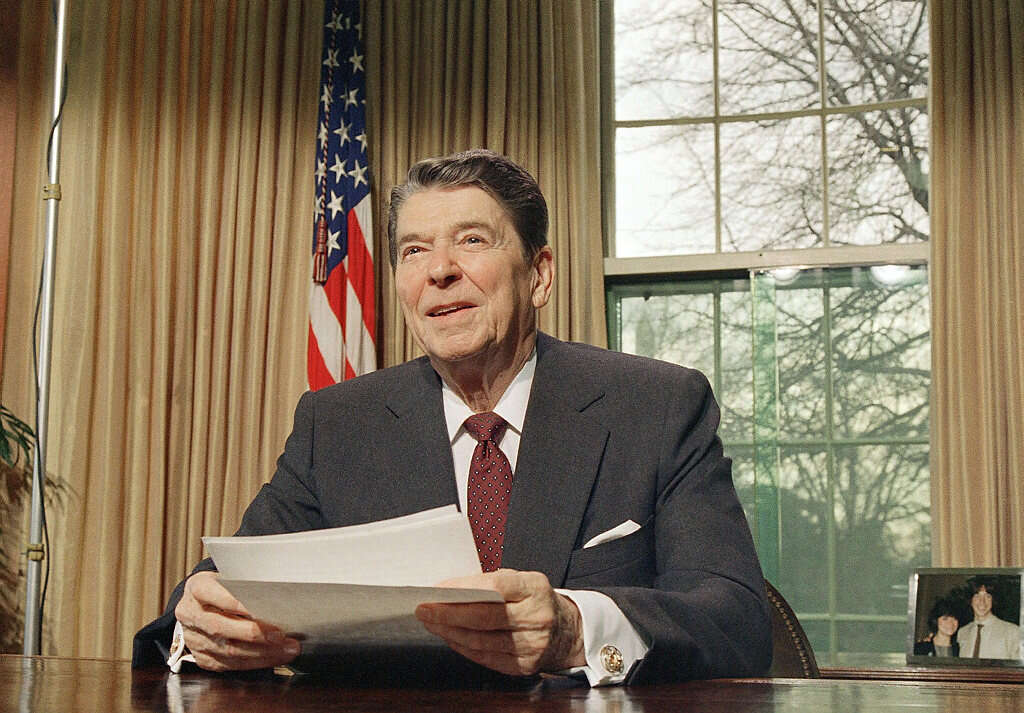

This decision disrupted global economic equilibrium, sent stock markets tumbling, and effectively launched a trade conflict between America and the international community. Laffer noted, "I've witnessed poor presidential performance. I observed Barack Obama, Joe Biden, George Bush Senior and Junior. Some were terrible presidents, but I've also seen excellent ones. Bill Clinton was an outstanding president, and I supported him twice," – while justifying Trump's approach.

His reasoning? "Following World War II, we showed tremendous generosity toward defeated nations (Japan and Germany), our allies (Western partners), and the global community. We permitted all countries to establish tariffs protecting their domestic production because they required industrial development. However, they've since grown substantially, yet our trade balance remains poor.

"This leads to my second point about reciprocity. America maintains the world's lowest tariffs, with few exceptions. Meanwhile, every one of these nations cherishes its protective tariffs. Japanese leaders favor shielding their established farmers. American automobiles cost $60,000 more in Japan than in the US due to barriers and various restrictions. Countless tariffs have accumulated against the US over the years."

Q: When Trump says straightforward that global trade treats the US unfairly...

"Absolutely, he's correct."

Q: I learned that economic stability is essential. However, when Trump implements tariffs, then delays them, reduces and increases them repeatedly, this contradicts stability principles.

"When outcomes are poor, you must retain flexibility to adjust. Previously, once tariffs were established, eliminating them proved difficult, leading to economic downturns. Currently, with presidential executive orders, I can implement measures immediately and reverse them the following day. This approach makes tariffs significantly less threatening, enabling Trump to compel nations into negotiations."

Q: Nevertheless, this is a trade war, with arguments suggesting trade wars harm everyone. American families will face greater challenges too. Manufacturing iPhones domestically would double costs, as would automobile production. This means inflation and declining living standards.

"Claiming 'trade wars harm everyone' is ridiculous. While everyone suffers losses, the amounts differ substantially. America represents the world's largest marketplace. During trade wars, it will experience losses, but far less than smaller nations. This gives Trump negotiating leverage, and I believe that's his strategy. Disregard the economics, theories, and statistics – I'm convinced he's bargaining with countries to bring them to negotiations, seeking freer trade arrangements. Ultimately, I think he aims to reduce tariffs and barriers while establishing new trade agreements, especially with China."

Q: He's still taking a risk?

"Absolutely. Profit always requires risk-taking, with possibilities of failure. However, free trade benefits are substantial, despite acknowledged risks."

Israel's economic solution

Overall, Laffer remains confident that Trump's strategy will succeed. Although the American president initiated economic warfare globally, individual nations will negotiate new trade agreements separately. This means America's negotiating strength with each country individually becomes more limited.

He believes China needs favorable US trade agreements as much as America does. The distinguished economist thinks that by establishing proper commercial relationships with the Asian powerhouse, Trump will simultaneously resolve political tensions concerning Taiwan.

Regarding Israel's wartime economy, Laffer acknowledges he's not a specialist in Israeli economic developments. Nevertheless, he offers several suggestions and predicts post-war economic prosperity for Israel.

"Comparing conditions to two decades ago, I've observed dramatic Israeli economic improvement. The entrepreneurship, innovations, business leaders, and technology companies – it's an extraordinary economy. Modern Israel has become highly sophisticated. War places enormous economic burdens, but it's temporary. When it ends, I believe you'll manage debt repayment. While debt levels are elevated, they're not critically excessive."

Laffer advises Israel to fundamentally restructure its taxation system. "Your tax rates are exceptionally high, approximately 45%, including an additional 3% surcharges. You should adopt flat tax approaches, increasing minimum rates while reducing maximum rates. These measures would significantly strengthen Israel economically post-war. You maintain extensive regulatory burdens that could also be reduced afterward."

Discussing his meetings with Netanyahu, Smotrich, and their teams, Laffer observed, "I've visited the Oval Office for 55 years. You become accustomed to productive conversations and sound policy development. Every discussion I conducted in Israel was exceptionally worthwhile. While I'm not an Israeli policy expert, I understand how conversations are structured, their progression, and issue evaluation. The people here demonstrate remarkable professionalism."